CORNERSTONE RESEARCH indices of securities class action filings characterize the intensity of securities litigation activity through time.

We group multiple litigation processes corresponding to the same underlying event (allegations of fraud resulting in stock price inflation and subsequent decline, etc) in one report card that we refer to as a "filing." We define the class period of the filing as the class period mentioned in the First Identified Complaint (according to the information in the Clearinghouse database). In most cases this class period corresponds to the first filed complaint or to the complaint that shows the most extensive class period.

Declines in market capitalization over extended periods may be driven by market, industry, and firm-specific factors. To the extent that the observed losses reflect factors unrelated to specific allegations in class action complaints, indices based on class period losses would not be representative of potential defendant exposure in class action litigation. DDL and MDL should not be considered indicators of liability or measures of potential damages. Instead, they estimate the impact of all the information revealed during or at the end of the class period, including information unrelated to the litigation.

For each filing we calculate two measures of decline in the market capitalization of traded common stock:

The indices exclude IPO Allocation, Analyst, and Mutual Fund Filings. The following indices describe litigation activity:

Class Action Filings Index® (CAF Index®) is a unique and proprietary method of financial and economics research and expert analysis, created and provided exclusively by Cornerstone Research in connection with, and as part of, its financial consulting and litigation support services. The methodology begins by parsing all securities class action filings into a "classic filings" sample that excludes IPO allocation, analyst, and mutual fund filings. The CAF Index® then sorts federal securities class action filings into categories according to whether they are related to the Credit Crisis, Chinese Reverse Mergers, Mergers and Acquisitions, or traditional filings. To avoid any double counting, the CAF Index® consolidates multiple filings related to the same allegations against the same defendant(s) through a unique record indexed to the first identified complaint. The CAF Index® is of great value to lawyers, expert witnesses, and economic consultants in legal proceedings and in settlement negotiations related to securities fraud class actions.

Disclosure Dollar Loss Index® (DDL Index®) is a unique and proprietary method of financial and economics research and expert analysis, created and provided exclusively by Cornerstone Research in connection with, and as part of, its financial consulting and litigation support services. The DDL Index® measures the value change in a defendant firm's market capitalization between the trading day immediately preceding the end of the class period and the trading day immediately following the end of the class period. The DDL Index® estimates the impact of all information revealed during or at the end of the class period. The DDL Index® is of great value to lawyers, expert witnesses, and economic consultants in legal proceedings and in settlement negotiations related to securities fraud class actions.

Dollar Loss on Offered Shares Index™ (DLOS Index™) is a unique and proprietary method of financial and economics research and expert analysis, created and provided exclusively by Cornerstone Research in connection with, and as part of, its financial consulting and litigation support services. The DLOS Index™ measures the aggregate change in value of shares acquired by class members (federal filings with only Section 11 claims and for state 1933 Act filings). It is the difference in the price of offered shares (i.e., from offering until the complaint filing date) multiplied by the shares offered. The DLOS Index™ should not be considered an indicator of liability or measure of potential damages. Instead, it estimates the impact of all information revealed between the IPO date and the complaint filing date, including information unrelated to the litigation.

Maximum Dollar Loss Index® (MDL Index®) is a unique and proprietary method of financial and economics research and expert analysis, created and provided exclusively by Cornerstone Research in connection with, and as part of, its financial consulting and litigation support services. The MDL Index® measures the aggregate change in value for all federal and state filings for the defendant firm's market capitalization from the trading day with the highest market capitalization during the class period to the trading day immediately following the end of the class period. MDL should not be considered an indicator of liability or measure of potential damages. Instead, it estimates the impact of all information revealed during or at the end of the class period, including information unrelated to the litigation.

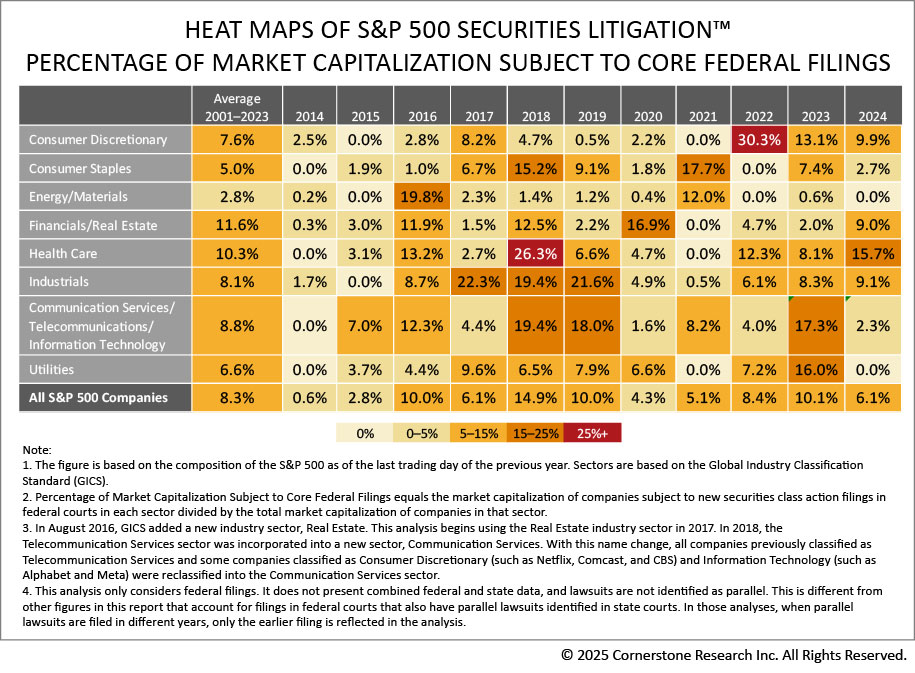

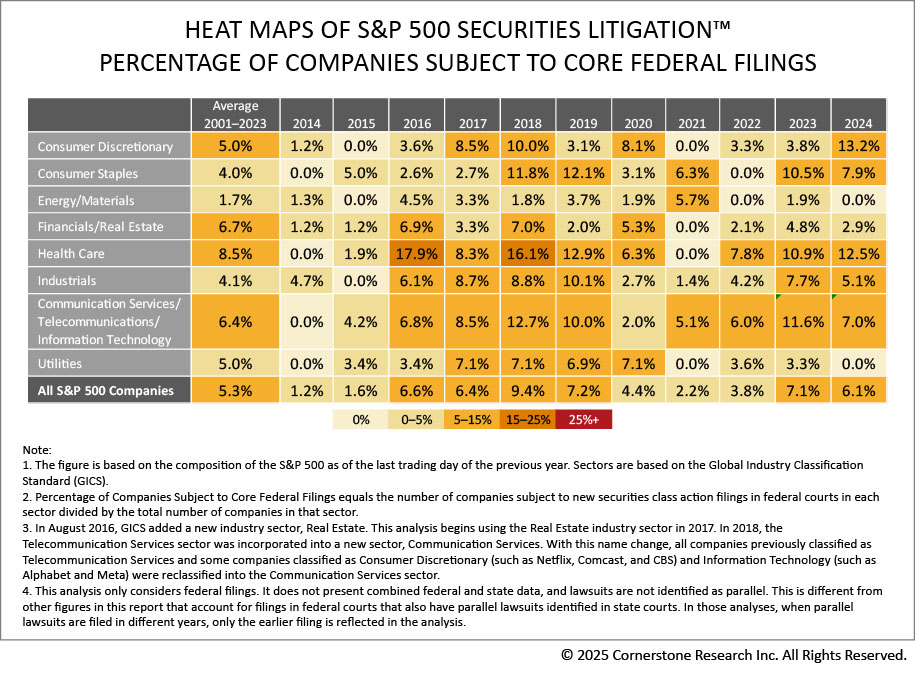

Heat Maps of S&P 500 Securities Litigation™ is a unique and proprietary method of financial and economic research and expert analysis, created and provided exclusively by Cornerstone Research in connection with, and as part of, its financial consulting and litigation support services. The Heat Maps of S&P 500 Securities Litigation™ analyze securities class action activity by industry sector. The analysis focuses on companies in the Standard & Poor's 500 (S&P 500) index, which comprises 500 large, publicly traded companies in all major sectors. Starting with the composition of the S&P 500 at the beginning of each year, the Heat Maps examine each sector by: (1) the percentage of these companies subject to new securities class actions in federal court during each calendar year, and (2) the percentage of the total market capitalization of these companies subject to new securities class actions in federal court during each calendar year.